Nowadays, nearly everyone knows the brand Volkswagen: “Das Auto” (“The Car”). With a turnover of €202 billion in 2014, Volkswagen is one of the largest companies in the world (eighth place in the Fortune Global 500 2014 ranking, based on turnover in 2013) and is certainly found in many investor portfolios. Therefore, we took the time to analyze the Wolfsburg-based group in more detail.

How many cars does Volkswagen sell?

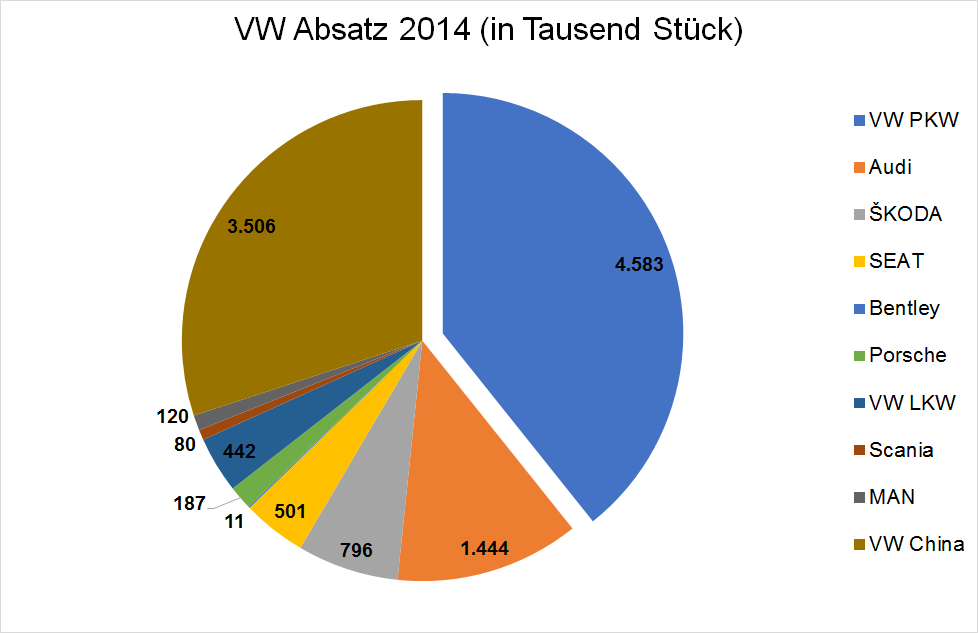

In 2014, the Volkswagen Group sold 10.2 million vehicles – the majority of which are passenger cars, although VW also sells trucks (with the brands VW Commercial Vehicles, Scania and MAN) and motorcycles (with the brand Ducati which belongs to Audi).

Compared with 2013, sales have increased by 5.0% (previous year: 9.7 million vehicles).

The figures do not add up to the above-mentioned sales figure of 10.2 million vehicles – this is due to consolidation effects of 1.5 million vehicles.

With its own brand “VW”, the company sold 4.6 million vehicles (39% of total sales before consolidation). If VW LKW and VW China are also included in the “inner VW circle”, this results in 8.5 million vehicles or 73% of total sales (again before consolidation).

The weakest brand in terms of sales is Bentley with 11,000 vehicles – the sales are so low that the brand did not even make it into our chart.

VW is and remains a passenger car group: if you divide the brand into passenger cars and trucks, the ratio equals 94:6. However, it is somewhat difficult to differentiate, as Audi also sells motorcycles (Ducati) and VW China also sells trucks (VW LKW).

How high is Volkswagen’s turnover?

VW achieved a turnover of €202.5 billion in 2014 – at least that’s what the official numbers say!

In our opinion, however, this is a figure that does not fully reflect economic reality, as the sales revenues of the joint ventures in China are not reported as “sales”. VW holds less than 50% of the joint ventures and therefore only reports the profit “at equity”.

VW’s turnover in China cannot be quantified precisely, as VW holds shares in several partner companies there:

- 40% in FAW-Volkswagen with €42.8 billion turnover

- 50% in Shanghai-Volkswagen with €23.1 billion turnover

- 30% in SAIC-Volkswagen Sales with €27.0 billion turnover

However, the sales shares of the participation in three partner companies cannot simply be added up, since the business purpose of SAIC-Volkswagen is the sale of cars for Shanghai-Volkswagen and thus internal sales exist which would be dropped in the case of consolidation.

We therefore estimate VW’s sales in China to be between €28.7 billion and €36.8 billion – the former figure only includes the sales share of FAW-VW and Shanghai-FW and the latter also the sales share of SAIC-VW. However, sales between FAW-VW and Shanghai-FW cannot be ruled out, which would again reduce VW’s share of sales (on a consolidated basis) a little.

In 2014, VW China generated an EBIT of €12.1 billion, an increase of 26% compared to the previous year (€9.6 billion). VW’s share of the EBIT 2014 amounts to €5.2 billion – an increase of 21% (€4.3 billion).

No matter how you look at it: China is Volkswagen’s most important single market!

How much does Volkswagen earn per car?

With a total sales volume of 10.2 million vehicles and a total turnover of €202 billion, we arrive at an estimated turnover of €19.818 per vehicle.

However, total sales include €22.1 billion in VW financial services and 3.5 million vehicles sold in China (whose sales are not reported as “sales” as explained above). Excluding both amounts, we arrive at an adjusted turnover per vehicle of €26.873.

However, it is important to point out that this does not correspond to the price paid by the customer to the VW dealer, but to the price paid by the car dealer to VW.

After all, turnover does not equal profit. VW reported a total EBIT (operating profit) of €12.7 billion for 2014, corresponding to an EBIT margin of 6.3% or an EBIT per vehicle of €1.243.

This value can also be adjusted: Deducting an EBIT of €1.7 billion from VW Financial Services and the 3.5 million vehicles sold in China, the adjusted EBIT per vehicle is €1.639 – corresponding to an adjusted EBIT margin per vehicle of 6.10%.

Of course it would also be interesting how the situation looks excluding financial services but including VW China. In this case, however, we would have to make assumptions about the consolidated sales of VW China which we are not comfortable with.

How much do the VW-brands earn per car?

What we also found interesting is the comparison of the individual brands, which you can find in the table below. The brands Ducati and Lamborghini are included in Audi.

| Marke | Umsatz je Fahrzeug | EBIT je Fahrzeug | EBIT-Marge |

|---|---|---|---|

| VW PKW | 21.768 | 540 | 2,48% |

| Audi | 37.249 | 3.566 | 9,57% |

| ŠSKODA | 14.771 | 1.026 | 6,95% |

| SEAT | 15.367 | -253 | -1,65% |

| Bentley | 158.727 | 15.455 | 9,74% |

| Porsche | 92.005 | 14.535 | 15,80% |

| VW LKW | 21.667 | 1.140 | 5,26% |

| Scania | 129.763 | 11.938 | 9,20% |

| MAN | 119.050 | 3.200 | 2,69% |

| VW Konzern | 19.818 | 1.243 | 6,27% |

| VW Konzern (excl. FS und excl. VW China) | 26.873 | 1.639 | 6,10% |

The most expensive brand is – would you have guessed? – Bentley, with an average turnover per vehicle of almost €168,000. The best margins, however, are generated by the Porsche business: around 16 cents per sold Euro or almost €15,000 per sold Porsche remain for VW as EBIT.

SEAT’s margin is even negative – reason enough for you to choose SEAT the next time you buy a car?

Please be aware that consolidation effects at group level (€40.0 billion sales and 1.5 million vehicles) are not included in this list either.

If you want to invest into a VW share in your portfolio, we can warmly recommend the OnVista offer. We hope you liked this overview! Please let us know your feedback in the form of a comment or an e-mail.

Which brands belong to the VW group?,Beste Broker-Angebote

Der erste Schritt zum Investment in Aktien, Anleihen, Fonds oder ETFs ist die kostenlose Eröffnung eines Broker-Accounts.

| Depot-Konto | Kosten je Order |

|---|---|

| € 2,00 + 0,018% | |

| € 3,99 |

| € 5,00 |

Risikofreie Eröffnung - keine laufenden oder Fixkosten (keine Depotgebühren)